The GBP/USD pair is holding firm ahead of Trump's expected tariff announcement. On Tuesday, the pound reached a weekly low of 1.2878, only to sharply reverse and return to 1.29. Meanwhile, other major currency pairs remain cautious, mostly trading within narrow price ranges.

This price movement in GBP/USD was influenced by optimistic remarks from UK Business and Trade Secretary Jonathan Reynolds, who expressed hope that reciprocal tariffs would soon be lifted due to an agreement reached between the UK and the US.

The pound reacted positively to the statement, although it was an empty phrase in reality—there are currently no ongoing negotiations between London and Washington, and there's not even a rough outline of a future deal. Besides, it's difficult to talk about agreements when the details of the new tariff plan remain unknown.

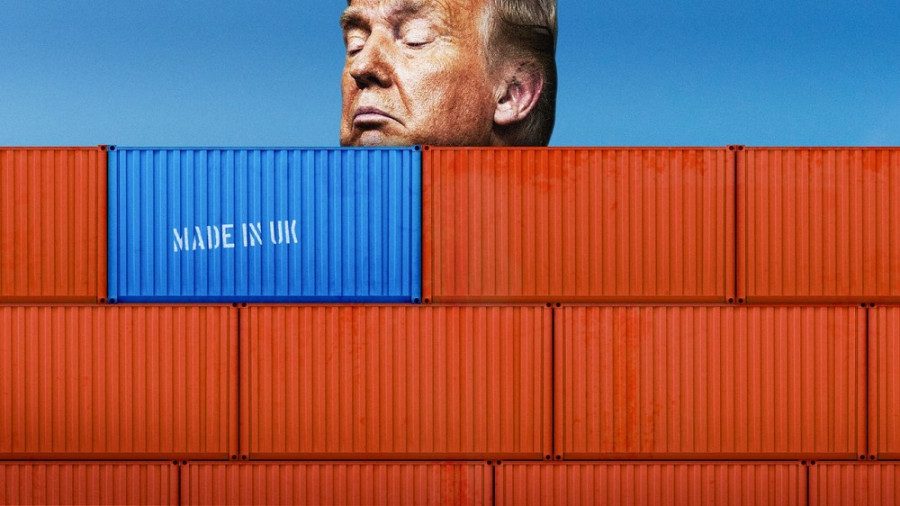

Nonetheless, the minister's overall positive tone and willingness to engage in dialogue had an impact, especially when contrasted with the combative stance of top EU officials. For instance, European Commission President Ursula von der Leyen stated that Brussels is ready to impose strict countermeasures "to negotiate from a position of strength in the future." According to Politico, the EU may slow licensing for American companies, tighten regulations on large U.S. tech firms, and impose taxes on major U.S. banks like Bank of America and JP Morgan.

In other words, while the EU prepares to escalate the trade war, the UK's trade minister is signaling a willingness to find a compromise. Reynolds said he believes tariffs will be lifted once both sides agree on the terms of a future deal. He mentioned that core principles may be decided upon first, followed by more detailed agreements "that would satisfy the U.S."

This stance allowed GBP/USD buyers to rebound from the weekly low, return to the 1.29 area, and even test resistance at 1.2940 (the upper boundary of the Kumo cloud on the 4-hour chart).

Interestingly, traders ignored Wednesday's ADP report, which came out in the "green zone." Instead of the expected 118,000 job gain in the U.S. private sector, the figure was 155,000. While the ADP report is often viewed as a leading indicator ahead of the Nonfarm Payrolls, the two reports are not always correlated. A strong ADP reading typically supports the U.S. dollar—but not this time. First, the result wasn't that impressive—it fell short of the key 200,000 mark. Second, traders in dollar pairs largely ignore macro data regardless of its tone. For example, Tuesday's ISM Manufacturing Index unexpectedly dipped into contraction territory (49.0), while the ADP report beat expectations. Still, traders were focused on the main event of the day: Trump's announcement.

Can the GBP/USD's upside impulse be trusted? In my view—no. Despite the UK minister's conciliatory rhetoric, his comments were vague and speculative. There's no guarantee that negotiations will begin anytime soon, let alone be successful. Thus, the pound is unlikely to sustain an independent rally—GBP/USD's direction will hinge on the U.S. dollar, which awaits the outcome of Trump's tariff plan.

Insider reports in the U.S. media vary regarding the plan's severity. Some say Trump will implement a universal 20% tariff on all countries—affecting $33 trillion in global trade. Others suggest that the White House will impose lower, country-specific tariffs. A third version says tariffs will apply to all countries but with a differentiated approach.

The suspense remains high and will continue until the last minute, meaning strong volatility is likely. The "compressed spring" is about to uncoil, and the only question is which direction it will snap—toward the dollar or against it. If the plan turns out to be softer than expected, the dollar will likely rally on eased recession fears. Conversely, the harshest version of the plan would heavily weigh on the greenback. The pound in GBP/USD will have no choice but to follow the dollar, lacking the strength for an independent move.

Therefore, despite the current rise in GBP/USD, entering long positions (or shorts) is not recommended. It was best to stay out of the market on Wednesday and Thursday while traders assess the implications of the new tariff plan.