Índices de Wall Street atingem recordes graças aos investimentos em Netflix e IA

Os índices de ações dos EUA apresentaram ganhos sólidos na quarta-feira, com o S&P 500 registrando uma nova alta intradiária. Os principais impulsionadores da dinâmica positiva foram os fortes resultados financeiros da Netflix e o ambicioso plano de investimentos de Donald Trump, que visa desenvolver a infraestrutura de inteligência artificial.

Tecnologia lidera o caminho

O setor de tecnologia registrou um ganho impressionante de 2,5%, liderando os 11 principais setores do S&P 500. O aumento foi impulsionado pelos ganhos das gigantes da IA Nvidia e Microsoft, cujas ações subiram acentuadamente na sessão.

Netflix inspira o mercado

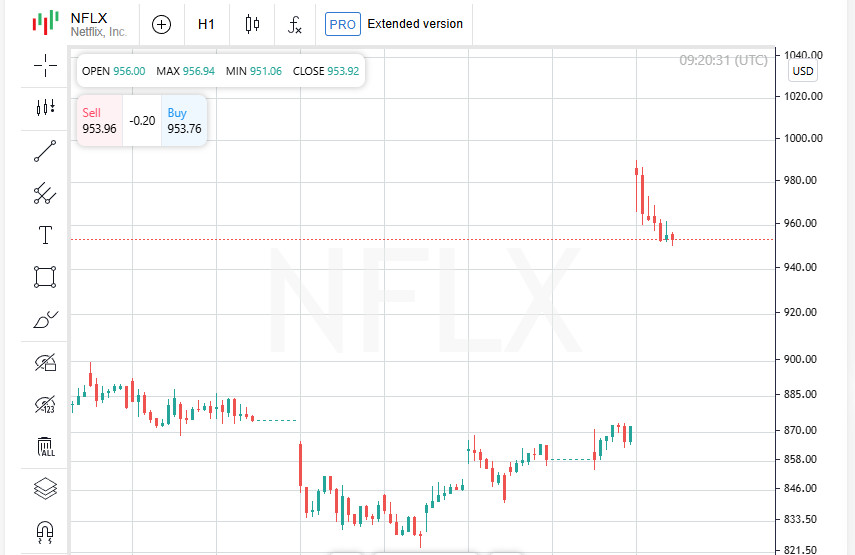

A Netflix subiu 9,7% com o crescimento recorde de assinantes durante a temporada de férias. Os resultados permitiram que a gigante do streaming anunciasse aumentos de preços na maioria de seus planos, reforçando ainda mais a confiança dos investidores em seu futuro.

IA no centro das atenções

Os investidores ficaram entusiasmados depois que Donald Trump anunciou um grande investimento em infraestrutura de inteligência artificial. O novo plano prevê que o setor privado invista US$ 500 bilhões, com a participação de grandes empresas como Oracle, OpenAI e SoftBank. No entanto, os detalhes de como o projeto será financiado ainda não estão claros.

Setores que lideraram e perderam

Com os serviços de tecnologia e comunicações ganhando 1,1% no dia, outros setores tiveram um desempenho mais modesto. O setor de serviços públicos foi o maior perdedor, com perda de 2,2%.

Principais participantes com ganhos

As ações da Oracle subiram 6,8%, enquanto a ARM Holdings, uma subsidiária da SoftBank e um participante importante no desenvolvimento de chips, subiu impressionantes 15,9%. A Dell, fabricante de hardware para servidores, também apresentou um crescimento constante, aumentando 3,6%.

Os resultados de quarta-feira mostraram que o investimento em inovação e a confiança em tecnologias futuras continuam sendo os principais impulsionadores para os investidores, e os mercados estão prontos para apoiar a tendência de inteligência artificial e soluções de alta tecnologia.

Wall Street continua subindo: mercados demonstram confiança

O S&P 500, o Nasdaq e o Dow Jones foram novamente o centro das atenções na quarta-feira, continuando sua tendência de alta. Os principais índices mostraram um crescimento confiante devido aos dados econômicos positivos, à diminuição das pressões inflacionárias e à abordagem cautelosa do presidente Trump em relação às tarifas.

Novo salto para os índices

O S&P 500 adicionou 37,13 pontos (+0,61%), encerrando o dia em 6086,37. Embora o índice tenha ficado apenas alguns pontos abaixo de seu nível recorde de fechamento de 1.090,27, estabelecido em dezembro, sua dinâmica continua a inspirar os investidores.

O Nasdaq Composite subiu com confiança 252,56 pontos (+1,28%) para 20009,34, rompendo pela primeira vez a importante barreira psicológica de 20 mil pontos.

O Dow Jones Industrial Average aumentou 130,92 pontos (+0,30%) e atingiu 44156,73.

O que está alimentando o apetite pelo risco?

Os investidores estão demonstrando otimismo devido a uma série de fatores:

- Indicadores econômicos sólidos. A melhoria dos dados macroeconômicos cria uma base sólida para um maior crescimento do mercado;

- A inflação está caindo. A desaceleração do crescimento dos preços está acalmando as preocupações dos participantes do mercado;

- Uma abordagem suave para as tarifas comerciais. Apesar dos temores iniciais, Donald Trump está adotando uma abordagem cautelosa nas negociações comerciais.

Entretanto, os traders continuam cautelosos. O presidente já advertiu que as tarifas sobre as importações da China, México, Canadá e UE poderiam ser introduzidas já em 1º de fevereiro. Essa declaração forçou os analistas a revisar suas previsões para o próximo trimestre.

Datas importantes no horizonte

Donald Trump ordenou que as agências federais preparem revisões comerciais abrangentes até 1º de abril. De acordo com os especialistas do Barclays, essa data será uma referência crítica para os mercados. Se a retórica comercial se intensificar, podemos esperar sérias oscilações no sentimento dos investidores.

Líderes e perdedores do dia

Entre as empresas individuais, o relatório da Procter & Gamble foi uma surpresa agradável. As ações da gigante de bens de consumo subiram 1,9% depois que a empresa superou as expectativas para o segundo trimestre. A demanda por produtos domésticos nos E.U.A. continua forte, apoiando os lucros da P&G.

Enquanto isso, a Johnson & Johnson foi ofuscada. Apesar do fato de a gigante farmacêutica ter apresentado resultados acima das expectativas, as ações caíram 1,9%. Os analistas atribuem isso às expectativas de mais pressão sobre a empresa em face do aumento da concorrência no setor.

Olhando para o futuro

Os mercados estão em um estado de expectativa: os participantes estão observando as novas declarações da Casa Branca e o resultado das negociações comerciais. Ao mesmo tempo, os sinais positivos de empresas como a Netflix e a Procter & Gamble dão motivos para otimismo. Como antes, os investidores estão prontos para apostar no desenvolvimento da tecnologia, no crescimento da demanda dos consumidores e na capacidade de adaptação da economia diante dos desafios globais.

Os mercados estão misturados, as ações caem e os futuros perdem terreno

Após uma impressionante recuperação no início da semana, o sentimento nos mercados começou a mudar.

As quedas nas ações individuais, as previsões decepcionantes e a fraqueza dos futuros sinalizam a cautela dos investidores.

As ações estão caindo: o que aconteceu?

A Ford foi o centro das atenções, perdendo 3,8% de seu valor depois que o Barclays rebaixou as ações. A decisão foi vinculada às expectativas de uma desaceleração no crescimento da montadora em meio aos desafios contínuos do setor.

A Textron também decepcionou o mercado, com as ações caindo 3,4% depois de emitir uma previsão de lucros para 2025 que ficou abaixo das expectativas dos analistas.

A Halliburton foi outra perdedora, com as ações da gigante dos serviços de campos petrolíferos caindo 3,6%, após alertar sobre a fraca atividade no mercado norte-americano e publicar um relatório trimestral pessimista.

Desempenho do mercado de ações

O sentimento dos investidores permaneceu amplamente negativo na Bolsa de Valores de Nova York (NYSE), com 1,55 ações caindo para cada uma que avançou. Ao mesmo tempo, foram registradas 271 novas máximas e 57 novas mínimas, destacando a mistura de tendências.

Desaceleração dos mercados globais

As ações globais, que vinham se recuperando devido aos ambiciosos planos de infraestrutura de IA de Donald Trump, começaram a perder o ímpeto na quinta-feira. Embora o otimismo esteja diminuindo, os mercados chineses conseguiram se destacar graças ao apoio de Pequim.

O entusiasmo com o enorme investimento em infraestrutura de IA está gradualmente dando lugar a expectativas realistas, à medida que os investidores começam a considerar os riscos e incertezas associados à implementação de tais projetos.

Futures Down

Os futuros de ações da Europa e dos EUA apontam para uma abertura fraca.

Esses dados refletem um clima de cautela contínuo entre os investidores, que estão analisando as possíveis consequências das mudanças nos fatores de mercado.

Olhando para o futuro

A dinâmica atual do mercado indica que os investidores estão se concentrando em dados macroeconômicos, relatórios corporativos e declarações de líderes mundiais. As previsões para as principais empresas e as expectativas de lucros, combinadas com a incerteza econômica global, desempenharão um papel importante na formação de tendências futuras.

Apesar de sinais isolados de desaceleração, o mercado continua a demonstrar resiliência, e a perspectiva de longo prazo para os principais setores continua atraente.

Os planos de Trump e as ações da China: mercados em uma encruzilhada

Os mercados globais continuam a reagir às principais iniciativas e declarações que moldam o sentimento dos investidores. O anúncio de Donald Trump de um investimento colossal de US$ 500 bilhões em infraestrutura de inteligência artificial foi um grande impulso, mas na quinta-feira o otimismo estava diminuindo.

IA em foco

A proposta de Trump inclui gigantes como Oracle, OpenAI e SoftBank, ressaltando a seriedade de suas intenções. A notícia inicialmente provocou uma onda de entusiasmo nos mercados acionários globais. Os índices nos EUA e na Europa, incluindo o STOXX 600 pan-europeu e o S&P 500 dos EUA, atingiram novos recordes nas sessões anteriores.

Entretanto, a euforia foi ofuscada por outras declarações do presidente: os planos de impor uma tarifa de 10% sobre as importações chinesas causaram tensão e introduziram um elemento de incerteza.

Mercados asiáticos: Um aumento de curto prazo

O índice MSCI, que acompanha as ações da região Ásia-Pacífico (excluindo o Japão), encerrou uma recuperação de sete dias e caiu 0,15% na quinta-feira. Os ganhos da manhã, desencadeados pelas novas medidas de Pequim para apoiar o mercado, não se mantiveram até o final do pregão.

China toma medidas contra a pressão

Diante das ameaças dos EUA, a China tomou suas próprias medidas para estabilizar seu mercado de ações. O governo anunciou planos para canalizar centenas de bilhões de yuans por meio de seguradoras estatais para apoiar as ações.

Essas medidas surtiram efeito: os índices da China apresentaram ganhos modestos. O índice CSI300, de primeira linha, subiu 0,19%, enquanto o índice Shanghai Composite subiu 0,53%. Entretanto, alguns desses ganhos foram perdidos no final da sessão, destacando o contínuo nervosismo dos participantes do mercado.

Sinais mistos

O plano de investimento de Trump provocou entusiasmo nos mercados globais, mas as tensões sobre as tarifas sobre as importações chinesas estão se tornando um fator de restrição. Pequim, por sua vez, demonstrou disposição para proteger seus interesses econômicos, o que ajudou a fortalecer temporariamente a posição dos índices chineses.

A questão de saber se a iniciativa de IA de Trump pode compensar as possíveis consequências de uma guerra tarifária continua em aberto.

Os mercados globais estão em uma encruzilhada. Os investidores estão avaliando o potencial das principais iniciativas de IA, mas também estão atentos aos riscos associados a uma relação comercial mais estreita. Dados macroeconômicos, lucros corporativos e desenvolvimentos no comércio internacional serão os principais impulsionadores nos próximos dias.

Mercados sob pressão: A China enfrenta desafios e as tarifas de Trump aumentam as tensões

Os mercados globais continuam a reagir aos desafios econômicos e políticos. Embora os índices asiáticos estejam mistos, a China enfrenta desafios econômicos, exacerbados pelas ameaças externas das tarifas dos EUA.

Hong Kong e China: Ansiedade econômica

O Índice Hang Seng de Hong Kong caiu 0,6%, refletindo a preocupação contínua dos investidores com a situação econômica da China. Alvin Tan, chefe de estratégia cambial asiática do RBC Capital Markets, disse que os fracos retornos das ações chinesas e a queda dos rendimentos dos títulos são indicadores de desafios domésticos. "A China está cada vez mais dependente das exportações líquidas para crescer e, se os EUA aumentarem a pressão tarifária, esses problemas só vão piorar", disse Tan.

Japão em alta

Enquanto isso, o índice Nikkei do Japão subiu 0,8%. As ações da SoftBank estavam entre as líderes, subindo 5%. O motivo foi o anúncio de um projeto conjunto com a OpenAI chamado Stargate AI. De acordo com fontes, cada uma das partes alocará US$ 19 bilhões para financiar a iniciativa, o que fortaleceu a confiança dos investidores no conglomerado japonês.

FX: Estabilidade após turbulência

O movimento nos mercados de câmbio foi relativamente moderado após a instabilidade causada pelos planos de Donald Trump de impor tarifas. O presidente dos EUA confirmou a possibilidade de impor tarifas de 25% sobre as importações do México e do Canadá até 1º de fevereiro, o que causou tensão entre os participantes do mercado.

O índice do dólar americano permaneceu perto de uma baixa de duas semanas, encerrando o dia em 108,26.

- O euro se estabilizou em $1,0408;

- A libra esterlina subiu para $1,2318.

O yuan da China se enfraqueceu para 7,2812 por dólar no mercado doméstico, refletindo as preocupações dos investidores sobre a economia do país.

Ameaças tarifárias: uma nova fronteira de tensão

Juntamente com as ameaças contra a China, Trump continua a aumentar a pressão sobre outros países. As possíveis tarifas sobre as importações do México e do Canadá, que podem chegar a 25%, estão aumentando o nervosismo. Os especialistas dizem que essas medidas podem desacelerar o comércio global, exacerbando a incerteza existente.

Perspectiva

Os mercados asiáticos continuam sob pressão, equilibrando o otimismo em relação às iniciativas tecnológicas com as preocupações sobre o aumento das tensões comerciais. Os investidores estão concentrados no que os EUA e a China farão em seguida e se as iniciativas de grandes empresas, como a SoftBank e a OpenAI, podem apoiar a resiliência do mercado. Com o aumento das tensões, é provável que os mercados permaneçam voláteis, aguardando o resultado da política comercial e as decisões dos principais agentes econômicos.

Mercados congelados em antecipação: dólar sobe, petróleo cai

Os mercados financeiros estão demonstrando cautela em meio às próximas decisões dos bancos centrais e aos riscos econômicos globais. O dólar continua a se fortalecer, enquanto os mercados de commodities permanecem sob pressão, refletindo o nervosismo dos participantes.

Dólar vs. iene: expectativas fortalecem posições

A moeda americana atingiu a maior alta em uma semana em relação ao iene, subindo para 156,76. Esse aumento está associado às expectativas de uma decisão do Banco do Japão, que pode aumentar a taxa em 25 pontos-base na sexta-feira. Os investidores já precificaram isso nas cotações, mas a atenção está voltada para a declaração do regulador, que pode fornecer mais informações sobre o curso futuro da política monetária.

Bancos centrais: Foco na Noruega

O Norges Bank anunciará sua decisão sobre a taxa de juros ainda nesta quinta-feira. Os especialistas esperam que o banco central norueguês mantenha seus principais parâmetros inalterados, indicando como as economias menores estão respondendo aos desafios globais.

Mercados de Commodity: Tarifas atingem o petróleo

Os preços mundiais do petróleo caíram em meio à ameaça de Donald Trump de novas tarifas. A proposta de impor tarifas adicionais alimentou preocupações sobre uma desaceleração do crescimento econômico global, o que, por sua vez, poderia reduzir a demanda por energia.

- O Brent caiu 0,41%, para $78,68 por barril;

- O WTI caiu 0,45%, para $75,10 por barril.

Os participantes do mercado estão preocupados com o impacto das possíveis restrições comerciais nas cadeias de suprimentos globais e na dinâmica da demanda.

Ouro permanece estável

Em meio à volatilidade nos mercados de moedas e commodities, o preço à vista do ouro permanece estável. Uma onça do metal precioso ainda custa $2.754,49. Esse valor reflete o comportamento cauteloso dos investidores que veem o ouro como um ativo seguro em caso de aumento da instabilidade.

Os mercados estão em um estado de expectativa, analisando o impacto tanto das decisões monetárias quanto das possíveis mudanças tarifárias. O foco continua sendo as ações dos bancos centrais, especialmente do Banco do Japão, bem como os próximos passos do governo Trump.

Para os mercados de commodities, os dados de oferta e demanda serão fatores-chave, bem como o desenvolvimento das negociações comerciais. Enquanto os investidores permanecerem cautelosos, a volatilidade poderá persistir durante a semana.