Tech Under Pressure: Nasdaq Falls Amid AI Uncertainty

The Nasdaq Composite Index lost more than 1% on Monday, with major tech names weighing on the market. Investors continue to worry about future demand for artificial intelligence solutions, especially ahead of chip giant Nvidia's earnings results.

The S&P 500 ended the day with a slight decline, demonstrating its third consecutive decline. At the same time, the Dow Jones managed to come out slightly positive. For the Nasdaq, this was already the third decline in a row, and also the fourth time in February that it has lost more than 1% in a day.

Concerns around demand for Nvidia chips

The market is anxiously waiting to see whether Nvidia will meet analysts' expectations, especially in light of the rapidly changing situation in the AI field. Recently, market participants have been concerned about the sustainability of demand for the company's expensive chips, which are a key component in the development of artificial intelligence.

Adding to the nervousness was the situation with Chinese DeepSeek, which surprised the market in January by releasing inexpensive AI models. This increased concerns that high investments in chips and infrastructure may be unjustified if cheaper alternatives become widespread.

Signals from Microsoft added to pessimism

The market also reacted to fresh data on the revision of Microsoft's strategic plans. TD Cowen said in a research note late Friday that the company has canceled significant data center leases in the U.S., which could signal a potential glut of AI infrastructure, further dampening investor expectations.

Despite this, Microsoft says its plans to spend more than $80 billion on AI and cloud development remain unchanged. However, the company acknowledges that strategic adjustments in certain regions are possible.

Investors Take Profits Amid Market Jitters

According to Gene Goldman, chief investment officer at Cetera Investment Management, investors are looking for reasons to take profits. "Any doubts around AI are a reason to exit assets, as this is the technology that has been the main driver of market growth in recent years," he said.

Overall, the current situation shows that the market is reassessing expectations for AI, and upcoming earnings reports from tech giants, including Nvidia, could be an important indicator of the future direction of stock indices.

Weak Economic Data Adds to Worries

Beyond tariff and inflation worries, market participants are increasingly concerned about the outlook for economic growth, especially after a series of disappointing macroeconomic data released last week and a weak outlook from retail giant Walmart.

"The market is in a state of uncertainty right now, caught between fears of inflation and fears of slowing economic growth," said Gene Goldman, chief investment officer at Cetera Investment Management.

Indices Mixed

Stock markets ended the trading session with mixed dynamics. The Dow Jones Industrial Average gained 33.19 points, or +0.08%, to close at 43,461.21. Meanwhile, the S&P 500 fell 29.88 points (-0.50%) to 5,983.25, and the tech-heavy Nasdaq lost 237.08 points (-1.21%) to end the day at 19,286.93.

Tech Under Attack, Healthcare Gains

Amid general market turbulence, healthcare-focused companies showed the best dynamics among sectors. The S&P 500 Healthcare Index rose by 0.75%, demonstrating the defensive nature of this sector. At the same time, the tech sector was among the outsiders, with its index losing 1.43% during the session.

The greatest pressure on the S&P 500 came from Nvidia shares, which closed trading down 3.1%. It was followed by semiconductor manufacturer Broadcom, which lost 4.9%. Amazon (-1.8%) and Microsoft (-1%) were also in the red.

The absolute leader in the decline in the tech sector was Palantir Technologies, a company specializing in the development of artificial intelligence-based solutions. Its shares fell by 10.5%, which was the largest percentage decline among leading IT companies.

AI Market Overheating: Correction or Trend Reversal?

According to Peter Boockvar, chief investment officer at Bleakley Financial Group, the tech sector's downturn signals the market is entering a new phase. "The undisputed dominance of AI companies is coming to an end. That doesn't mean their stocks are no longer interesting, but the market is now entering an important revaluation phase," the expert explained.

Overall, the current situation confirms that investors remain cautious, and upcoming macroeconomic reports and corporate results could be decisive for the further direction of stock indices.

Investors prepare for the publication of inflation data

Market participants are currently focused on the consumer spending index, which will be released on Friday. This indicator, considered the Federal Reserve's preferred inflation indicator, could clarify the prospects for the first interest rate adjustment this year.

Interest rate futures currently indicate that traders expect the key rate to remain at the current level until at least June, according to data from the FedWatch tool from CME Group.

Apple bets on US investments

Despite the overall decline in the market, Apple shares ended trading with a gain of 0.7%. Investor optimism is caused by the company's plans to invest $500 billion in developing its business in the US over the next four years. Among the key initiatives is the construction of a plant in Texas, which will manufacture servers for artificial intelligence technologies.

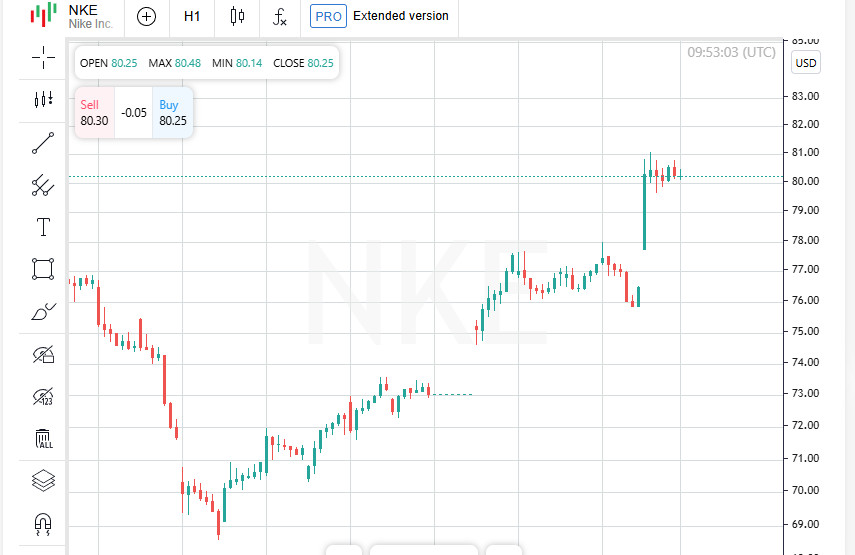

Berkshire Hathaway updates records, Nike receives support from analysts

One of the main winners of the session was the investment conglomerate Berkshire Hathaway, founded by Warren Buffett. The company's shares reached an all-time high after the publication of reports, where a record annual profit was recorded. Class B securities rose in price by more than 4%.

Nike shares, meanwhile, soared 4.9% after Jefferies upgraded their outlook from "hold" to "buy." This decision was a positive signal for investors hoping for a further recovery of the sports brand.

European markets balance between growth in defense stocks and a fall in technology

Trading on European stock exchanges was restrained on Tuesday. The STOXX 600 index, which reflects the state of the region's largest companies, added only 0.07% by 08:16 GMT.

At the same time, defense companies showed confident growth, offsetting pressure from the technology sector. The SX8P technology index was among the main outsiders, losing 0.9% amid growing tensions in relations between the United States and China, which increases fears of a further escalation of the technology war.

Overall, markets continue to move in a state of uncertainty, awaiting signals from both regulators and the largest players in the corporate sector.

Washington Tightens Control Over Tech Sector

The United States is preparing to tighten restrictions on China's semiconductor sector, expanding existing measures to limit Beijing's technological progress, Bloomberg News reported on Monday. The new round of sanctions is a continuation of the Biden administration's strategy to limit China's access to advanced technology and manufacturing capacity in the microchip sector.

Chipmaker Shares Under Pressure

The news sent shares of leading European semiconductor companies lower. STMicroelectronics fell 1.4%, while Dutch giant ASML fell 1.6%.

In addition, companies actively implementing artificial intelligence also felt the negative impact. Schneider Electric shares fell 1.3%, while Siemens Energy shares fell 2.2%.

Unilever Slips After Management Change

Consumer giant Unilever was among the market's laggards. Its shares fell 3% after the announcement of a management reshuffle. Current CEO Hein Schumacher is leaving his post, and the company's current CFO Fernando Fernandez will take over. Investors took the news with caution, which caused a sell-off in shares.

Defense Companies in Focus: Germany Prepares for Major Infusions

In contrast to the overall market decline, European defense companies were among the leaders in growth. The SXPARO industry index strengthened by more than 1% after reports that the incoming German Chancellor Friedrich Merz is discussing the allocation of up to 200 billion euros (approximately $209.44 billion) for defense needs.

This initiative immediately affected the quotes of German arms manufacturers. Rheinmetall shares rose by 2.6%, Hensoldt added 2.5%, and Renk shares jumped by an impressive 6.1%.

Thyssenkrupp strengthens amid reforms

Another favorite of the trading session was the industrial group Thyssenkrupp. Its shares soared by 6% after the company's head announced an upcoming shareholders' meeting, at which the spin-off of the military ship manufacturing division into an independent structure will be discussed.

Overall, financial markets continue to demonstrate multidirectional dynamics, reacting to geopolitical events, macroeconomic factors and corporate decisions of the largest players.