Analysis of Trades and Trading Tips for the Japanese Yen

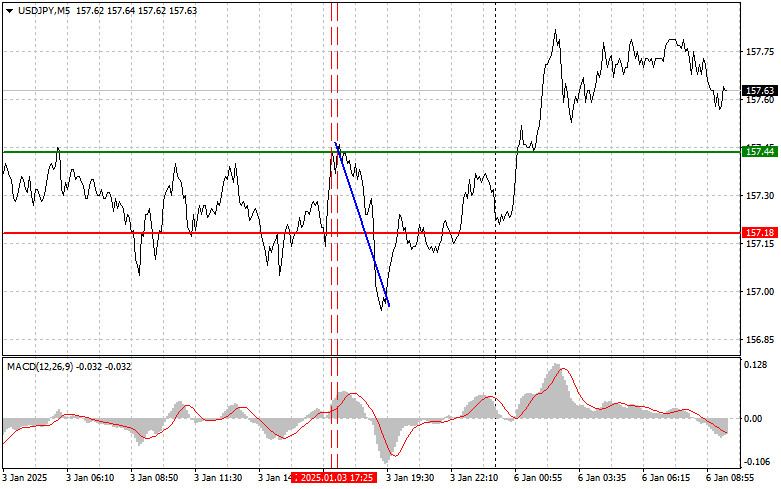

The first test of the 157.44 price level occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential. Since buyers once again stalled near the 157.44 area, the second test of this range, after a short period with the MACD in the overbought zone, resulted in the implementation of Scenario #2 for selling. As a result, the pair declined by more than 40 pips.

Today's reports on Japan's Services PMI and Composite PMI were weaker than economists' expectations, nearly dropping below the 50-point threshold. The data indicate weak growth in Japan's service sector, raising concerns about the sustainability of the country's economic recovery. The Services PMI fell to 50.9, just 0.9 points above the level that separates growth from contraction. Meanwhile, the Composite PMI, which combines manufacturing and services data, also declined to 50.5, slightly above the critical level. Economists attribute this to slowing growth in new orders and reduced export opportunities. Additionally, companies report increasing labor and raw material costs, putting additional pressure on profitability. Further deterioration in these metrics could jeopardize the Bank of Japan's plans for normalizing monetary policy. Amid weak domestic demand and external risks, such as a slowing Chinese economy and geopolitical tensions, Japan's economic recovery may be slower than anticipated.

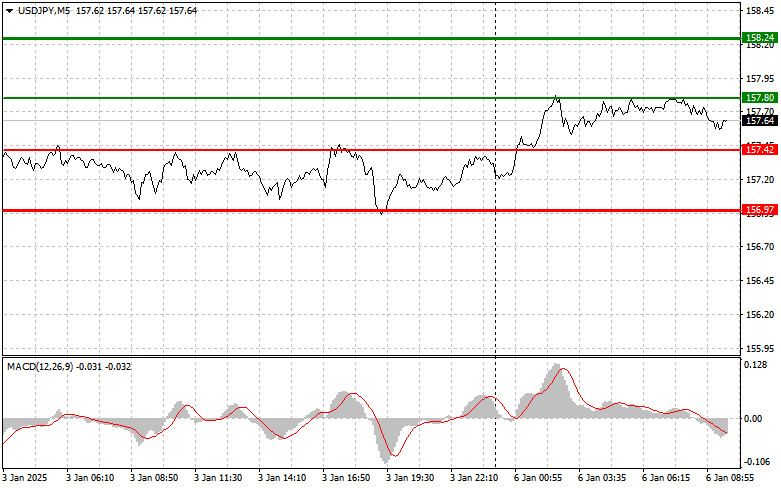

I will focus primarily on implementing Scenarios #1 and #2 for the intraday strategy.

Buy Signal

Scenario #1: I plan to buy USD/JPY today at the entry point around 157.80 (green line on the chart) with a target of 158.24 (thicker green line). At 158.24, I plan to exit purchases and open sell positions in the opposite direction, expecting a movement of 30–35 pips in the opposite direction. The best approach is to target further growth of the pair and buy on corrections. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the 157.42 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth can be expected toward the opposing levels of 157.80 and 158.24.

Sell Signal

Scenario #1: I plan to sell USD/JPY today only after breaking below the 157.42 level (red line on the chart), likely leading to a rapid decline in the pair. The key target for sellers will be 156.97, where I plan to exit sales and immediately open buy positions in the opposite direction, expecting a movement of 20–25 pips in the opposite direction. Significant pressure on the pair is unlikely to return today. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 157.80 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward the opposing levels of 157.42 and 156.97.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.