The GBP/USD currency pair also traded lower on Thursday. This decline can be attributed to several reasons, and the European Central Bank meeting is not among them. To begin with, the euro and the pound often trade in tandem—if not 100%, then at least 80% of the time. Thus, when the euro declines, there is an 80% probability that the pound will follow. This is almost axiomatic. Furthermore, the pound, like the euro, has no fundamental reasons for medium-term growth and has been correcting over the past few weeks. The trend remains bearish on both the 4-hour and weekly timeframes. Therefore, after the correction concludes, a new wave of the downtrend was to be expected, which is likely what we are witnessing now.

The ECB meeting may have acted as a trigger. However, there is no certainty yet that the correction is complete. It is important to remember that corrections can be lengthy and complex. Eventually, they do conclude, and market makers accumulate positions in the desired direction during their formation. This makes corrections an opportune time to open trend-following positions. Of course, everyone wants to enter the market at the exact peak and exit at the lowest point, but this is exceedingly rare. Therefore, we believe now is a good time to start gradually opening new medium-term short positions.

Next week, the Federal Reserve and the Bank of England meetings are scheduled, but they will carry the same weight as the ECB meeting. The BoE is 90% likely to leave its key rate unchanged, while the Fed is 90% likely to cut its rate by another 0.25%. This scenario has already been priced into the market. It inherently suggests further declines for the British pound because the market has already accounted for nearly the entire easing cycle (perhaps even overestimated it). Moreover, Donald Trump's return to power could drive inflation higher, forcing the Fed to either reduce its rate less aggressively or raise it again, providing additional support for the U.S. dollar.

The pound, on the other hand, is left to rely on the BoE. If the British central bank cuts rates next week, it will further pressure the pound. From our perspective, the pound's decline has just begun. Inflation is the only factor that might save the pound from a steeper drop. If inflation remains persistently high, the BoE might implement fewer than the four expected rate cuts next year. However, this scenario currently seems unlikely.

On the 24-hour timeframe, the price corrected to the critical line but failed to consolidate above it throughout the week. Thus, a rebound and a new wave of decline remain the baseline scenario. This week, the pound sterling has little chance of finding support. Very few significant reports exist in the U.S. or the UK, and even those can hardly be called "important."

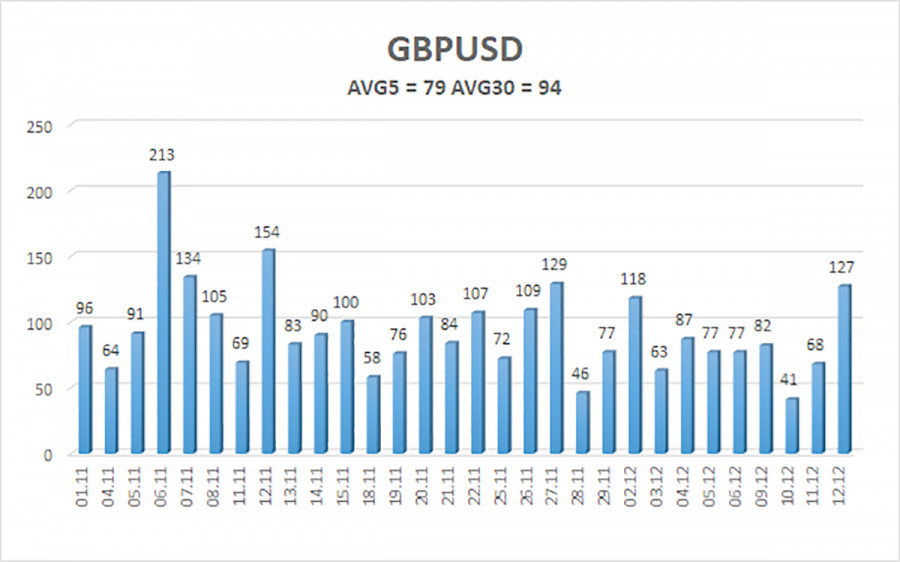

The average volatility of the GBP/USD pair over the last five trading days is 79 pips, considered "average" for this pair. On Friday, December 13, we expect the pair to trade within the range of 1.2594 to 1.2752. The higher linear regression channel is directed downward, signaling a bearish trend. The CCI indicator has entered the oversold area again, but the pound may resume its downward trend.

Nearest Support Levels:

- S1 – 1.2695

- S2 – 1.2573

- S3 – 1.2451

Nearest Resistance Levels:

- R1 – 1.2817

- R2 – 1.2939

- R3 – 1.3062

Trading Recommendations:

The GBP/USD pair maintains a bearish trend but continues to correct. We are still not considering long positions, as we believe all factors supporting the pound's growth have been priced into the market several times over. For those trading based on pure technical analysis, long positions could target 1.2817 and 1.2939 if the price moves above the moving average line. However, short positions are far more relevant now, with a target of 1.2573.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.